Carbon Fiber Growth in the Automotive Market

08 January 2018

Tags : automotive,

automotivemarket,

carbon,

CO2,

composite,

curing,

electricalcars,

fiber,

industry,

Kordsa,

lightweight,

market,

Reinforcer,

resin,

the reinforcer

This article is an introduction to carbon fiber sales growth in automotive programs, market trends, competition in the materials sector, client road maps, the boom in electrical cars and the Kordsa CM11 fast curing carbon prepreg solution.

1. Will Carbon Fiber Composites Find Extensive Uses in the Automotive Industry?

Carbon fiber-reinforced plastics (CFRPs) are finding their way into new applications as industries demand materials with ever-higher strength-to-weight ratios, corrosion resistance, and workability. Over the past years, CFRPs have been increasingly used to replace metal in applications where light weight has outsized value primarily for reducing fuel consumption and reducing CO2 emissions, and in particular where it is capable of supporting prices that can reach an average of 60-70 Euro/kg.

CFRPs applications are present in high-value sectors such as sporting goods, the aerospace industry and supercars, but priced out of most large-volume markets, particularly the mainstream automotive industries. This will continue until emerging methods and materials speed up CRFP production and bring down high prices.

Kordsa has concentrated particular attention on reducing labour costs for both molding processes and the preparation (sanding and painting) of interior/exterior CFRP parts with the launch of the CM11 fast curing resin system, which, in parallel to the 3-to-5 minute press cycle, ofers a great class-A surface finish without pinholes and carbon fiber print-through marking.

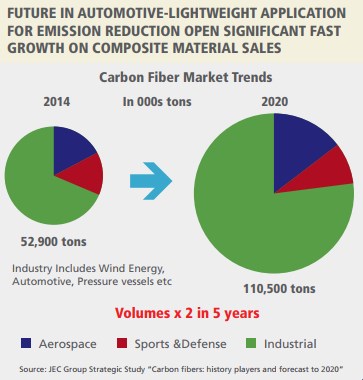

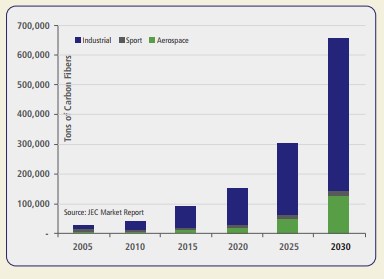

According to recent published reports, the usage of carbon fiber in automotive manufacturing is expected to nearly double from 2015 to 2020. According to these reports, global car production is expected to rise over the next couple of years to more than 110 million units in 2025, up from an estimated 88.7 million units in 2015. Much of this growth will come from the fast-expanding Chinese market. One report says the average car will incorporate nearly 350 kilograms (771.63 lbs) of plastics, up from 200 kilograms (440.92 lbs) in 2014.

“While metal and metal alloys are still critical to automotive design, automakers are finding innovative ways to leverage plastics and composites into their designs to help reduce vehicle weight and improve efficiency. We expect the use of plastics will only increase as the materials improve and production costs are reduced.”1 This is driven by increasingly ambitious government goals of meeting Corporate Average Fuel Efficiency (CAFE) standards of 54.5 mpg by 2025. In order for those goals to be feasible, fuel economy must be improved by approximately 50 percent across the passenger vehicle fleet. The use of carbon fibers and polymer matrix composites enables car body-weight reductions of an estimated 25-70 percent compared to competing materials.

“Closures, which include doors, lift-gates and hoods, are the easiest options to significantly reduce vehicle weight, and we see significant opportunities for composites in those as well as non-critical structures such as seats, instruments, the under-tray etc.

”1 1: JEC Group Strategic Study “Carbon fibers: history, players and forecast to 2020 By 2020,

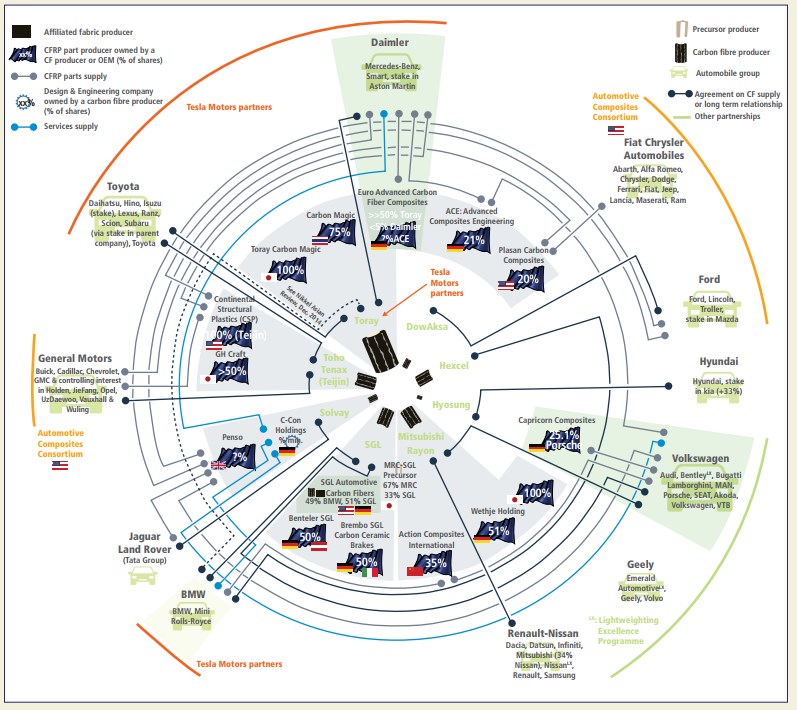

CFRPs are expected to comprise a $35 billion market, including a $6 billion slice of the automotive market. However, these automotive uses will be limited to luxury and racing vehicles. Analyses indicate that large-scale, mainstream CFRP automotive adoption before 2020 is unlikely. But sometime after 2020, the potential volume of CRFP used in cars and trucks could dwarf all other applications, potentially reaching hundreds of billions of dollars. As a result, most major automotive companies and carbon fiber producers are forming partnerships, joining consortia, and conducting research to bring automotive CFRPs closer to commercial reality. The Carbon Fiber Composites Consortium remains the most connected entity on the automotive partnership map, with 23 OEM, Tier 1, and major material supplier partners.

2. The Future of the CFRP Automotive Market: the JDA Alliance Between OEM and Composite Material Suppliers

Source: JEC Magazine, no. 112, April–May 2017, p. 21

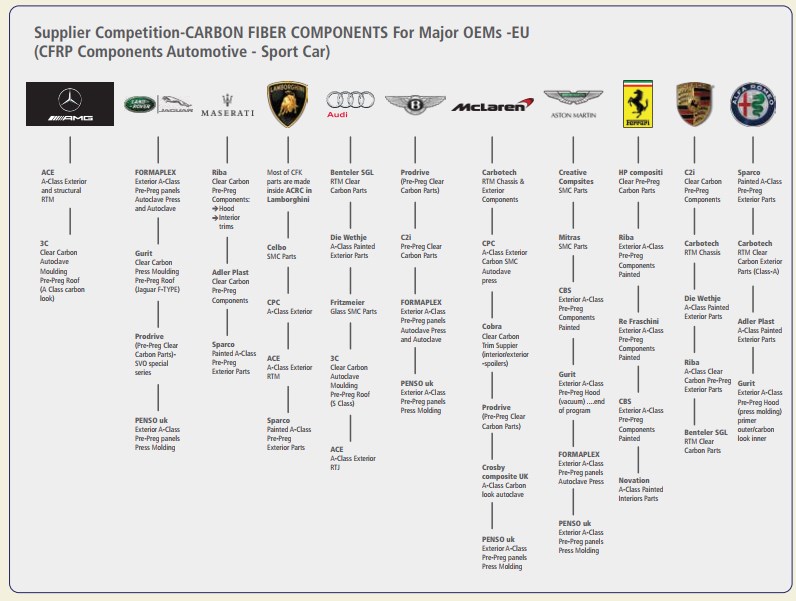

Table 2: In reality, most major automotive companies and carbon fiber producers are forming partnerships, joining consortia and conducting research to bring automotive CFRPs closer to commercial volume program applications. As you can see here, Kordsa have now begun making contacts and obtaining material test approval to begin similar JDA/technology partnerships with top automotive OEMs and Tier 1 CFRP components manufacturers.

In addition to advances in fiber production, suppliers throughout the value chain are developing faster, more efficient equipment and resins designed for automotive CFRP use, as well as scalable CFRP recycling methods. More recently, BMW has partnered with Boeing, a world leader in using CFRPs for aerospace manufacturing. The two hope to improve CFRP production and recycling. By leveraging both upstream fiber capacity investment and the knowledge of experienced players like Boeing, BMW is positioning itself to lead the way in both large-scale automotive CFRP manufacturing and automotive group technology partnerships with aerospace companies.

The future still remains uncertain. Development trends underway in fiber, resin, and composite part production strongly suggest that by the mid-2020s, it will be technically and economically feasible for automotive OEMs to make mainstream vehicles that use significant amounts of CFRPs.

Fundamentally, the CFRP technology push toward automotive composites is predicated on the idea that reducing weight is a cost-efficient method for reducing fuel consumption. (A 10 percent reduction in weight typically leads to a 6 to 8 percent reduction in fuel consumption.) As a result, vehicles will gradually become lighter as fuel economy standards become stricter. Meanwhile, CFRPs-the materials with the highest weight-specific strength—will be waiting to be used when they get cheaper. Low-cost fibers may become a reality in the next 10 to 12 years, once the industry is able to adopt methods that facilitate low-cost, large-scale production processes. Additionally, recycling carbon fibers will boost adoption across industries in the medium to long term."

3. Market Trends

The aim of Kordsa is to supply the best possible materials solutions for manufacturing large volume, low-cost, good quality composite parts through:

The aim of Kordsa is to supply the best possible materials solutions for manufacturing large volume, low-cost, good quality composite parts through:

- Vertical integration in semi-finished products (textiles, prepregs, pre-cutted preform): to be cost competitive and be able to supply material for both RTM and press molding processes,

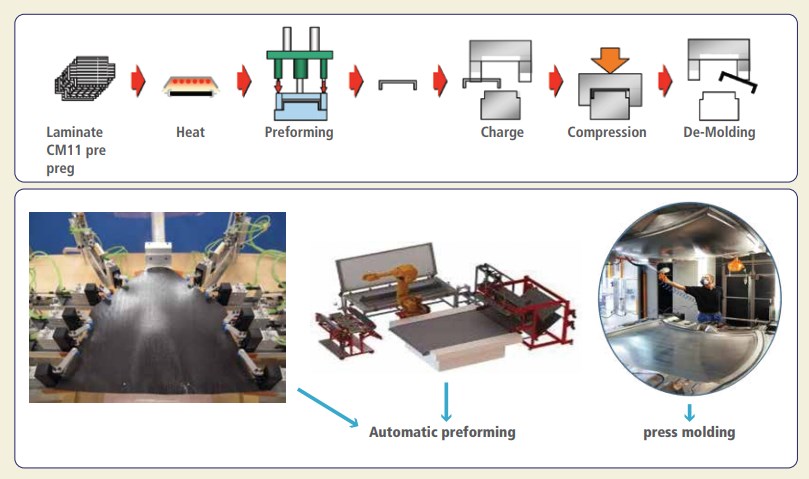

- To reduce drastically the time taken in the lamination step (the most time-consuming and costly step in composite manufacturing) by developing fast-curing prepregs like CM11 which is one of the fastest-curing press prepregs in the market, to support customers for suitable materials for automatic process of picking, deformşing and placing prepregs/textiles to manufacture ready-to-mold pre-forms (essential materials for metal stampers),

- Structure: introducing CM11 prepregs, carbon fabrics, materials library tests and solutions in order to be able to follow the programs of large industrial automotive corporations,

- Goal: to create closer relationships with automotive plants and Tier 1 manufacturers in Europe and in future to follow up with growth in the Far East (China) and U.S.

Table 3: Carbon fiber composites for industrial and automotive applications are the fastest-growing markets today, especially in mid-segment cars where there is the need to produce large volumes of geometrically complex structural/aesthetic parts at an affordable price.

4. Client Road Map and Carbon Componants

Table 4: The main Tier 1 and OEM road map is shown here. Kordsa focuses on supporting every step of this OEM supplier chain.

Table 5: Lightweight materials options in various applications and weight reduction percentages

5. Carbon Fiber Automotive Prepreg Sales Growth as a Result of a Lightweight Main Components Program: the Boom in Electrical Cars and CO2 Emissions Restrictions

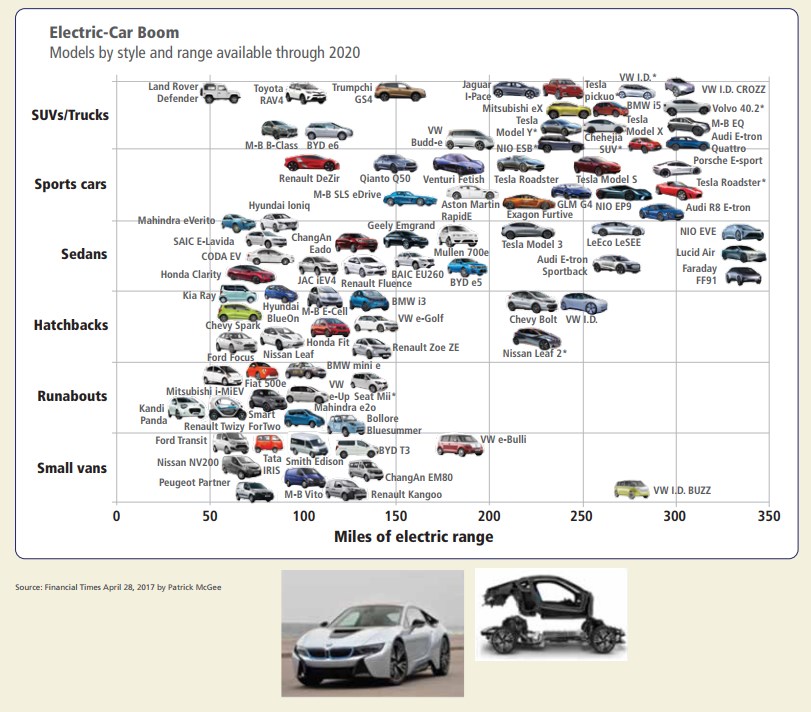

In electric vehicles, the payof for reducing weight is even greater due to secondary cost savings from using smaller, lighter batteries. However, alternative methods of reducing gasoline use such as hybridization and using alternative fuels like natural gas, hydrogen, and biofuels, are gradually becoming less costly as their underlying technologies continue to advance.

Current trends still strongly indicate significant automotive adoption of CFRPs in the mid-2020s, and companies throughout the value chain must position themselves to take advantage of the coming shifts. However, those developing these technologies should consider that there could be a limited long-term window for penetrating the automotive industry

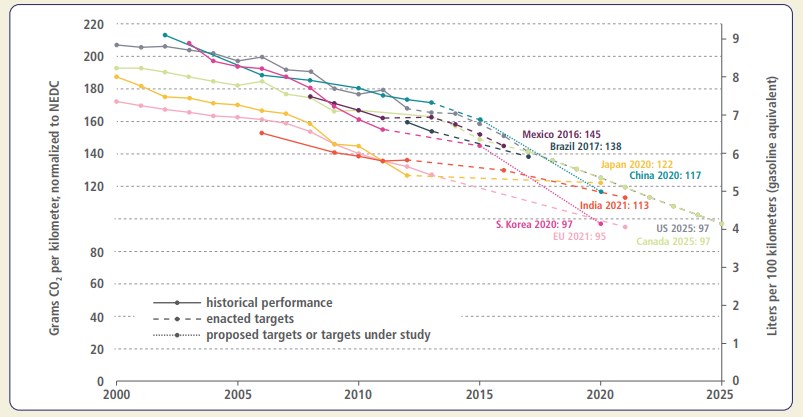

Source: http://www.theicct.org/info-tools/global-passenger-vehicle-standards

Table 6: This graphic clearly shows how drastic gasoline consumption and CO2 emissions reductions in the automotive industry will be. Companies like Kordsa will offer new lightweight materials and engineering solutions every year to produce lightweight cars and lightweight solutions for future hybrid electrical cars as their sales boom in future. (Composite materials will help to compensate for the extra weight of installing batteries and electrical engines.)

6. The CM11 FastCuring Resin System: the Carbon Prepreg Kordsa solution for High Volume Production

Feature:

- Tg > 170°C

- Low color fastening (AE

- Compression molding cure profile suitable for isothermal curing at 120 to 150 °C, 10 to 50 Barr, hot-demoldable, 3-to-5 minute curing

Demand:

- Automotive industry takt times are usually 30 to 120 seconds excluding luxury cars.

- The Past: Cutting patterns, preforms, and compression molding are consecutive processes. It is possible to produce one piece every 10 minutes.

- Now: With current bleeding-edge resin technology one piece can be produced every 3–5 minutes (with Kordsa CM11, the fastest-curing prepreg in the market)

- The Future: one piece will be produce at the takt time (30 to 120 seconds)

Benefits and Value Proposition:

Quick cure compression moldable prepregs with class A surface properties:

- Kordsa is a local supplier and will produce custom designed prepregs for local customers, which is unheard of for prepreg composite producers.

- New resin systems will have oxidative and thermal stability, which customers demand. Kordsa has already has exceptionally good-looking carbon fabric weaving and customers are excited about the idea of a new resin composition with class-A surface quality.

- Right now, Kordsa delivers CM11 pre-preg to produce complex 3D shape parts which are suitable for automatic continuous preform and isotherm continuous molding systems (150°C) to meet high production volume targets with high dimensional stability and a class-A surface finish.

Future Kordsa Materials Evolution: Tier 1 metal stampers prefer to use a semi-finished product which can be placed directly in a press, like metal sheets. In composites, such product are ready-to-mold pre-forms, and metal stampers prefer it in order to avoid having to relearn the lamination process from zero. The manufacturing and sales of ready-to-mold pre-forms (storable at room temperature) allow a company like Kordsa to reduce the time to market by delivering a semi-finished product that metal stampers can use as a reference for room temperature storage pre-form resin systems. Kordsa, following these requests, will develop a molding solution in future that works very closely with all the biggest Tier 1 metal groups.

Tags : automotive,

automotivemarket,

carbon,

CO2,

composite,

curing,

electricalcars,

fiber,

industry,

Kordsa,

lightweight,

market,

Reinforcer,

resin,

the reinforcer