Nylon, Age-Old or Revolutionary?

What is Nylon?

What is Nylon?

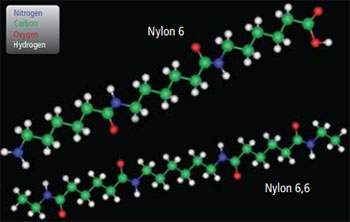

Nylon is found everywhere around us. It is in the toothbrush we brush with, the carpets we walk on, the jackets we go skiing in, the baskets in our dishwashers, and the tires on our car. It is hard to believe that nylon has been around for more than 75 years, starting as a replacement for silk in women’s stockings; then becoming strategic to World War II in flak jackets and parachute cord. It is even harder to believe, but nylon is even more relevant to us today and continues to grow in importance despite so many other polymers having been developed over the years. Nylon constitutes a family of resins, the most important of which are nylon 6 and nylon 6,6. Nylon 6 and nylon 6,6 are the most successful and highest-volume members of the nylon family and are the focus of this report. The naming convention recognizes that nylon 6 is made from a single six-carbon monomer, caprolactam, and that nylon 6,6 is made from two six-carbon feedstocks, hexamethylenediamine and adipic acid. During polymerization, the carbon chains are linked together with an “amide” chemical bond with the resulting polymer generically referred to as a polyamide.

Nylon is a thermoplastic material that can be melt-processed into fibers, films, or shapes. Themoplastic means that it can be remelted and reshaped, as opposed to thermoset plastics like rubber, which cannot easily be remelted and reshaped. End-use applications for nylon polymers fall into two broad categories: fibers and engineering resins. Nylon extruded into fibers of various forms is used in clothing, carpets, tire cords, and other textile applications. Nylon engineering resins are molded into various uses including auto and appliance components, electric insulators, and a wide variety of consumer goods and packaging.

Nylon is a thermoplastic material that can be melt-processed into fibers, films, or shapes. Themoplastic means that it can be remelted and reshaped, as opposed to thermoset plastics like rubber, which cannot easily be remelted and reshaped. End-use applications for nylon polymers fall into two broad categories: fibers and engineering resins. Nylon extruded into fibers of various forms is used in clothing, carpets, tire cords, and other textile applications. Nylon engineering resins are molded into various uses including auto and appliance components, electric insulators, and a wide variety of consumer goods and packaging.

Nylon as a Fiber

Nylon as a Fiber

Fibers consume about 58 percent of the global demand for nylon. Textile filament for apparel and industrial filament for tires and auto airbags are the primary fiber forms produced today, accounting for nearly 80% of the total nylon fiber market and growing at an estimated 2.1 percent per year for the next five years. The textile apparel market continues to be the victim of changing consumer preferences as well as advances made in polyester filament. In fact, polyester has advanced against almost all apparel fibers, natural and synthetic, and is now the predominant fiber, having almost a 50 percent share of the global fiber market. Changing technology, such as passenger tires going from bias to radial, has also spawned further growth for polyester at the expense of nylon. However, nylon fiber continues to be used in a growing number of specialty applications requiring durability, light weight, and resistance to weathering and abrasion.

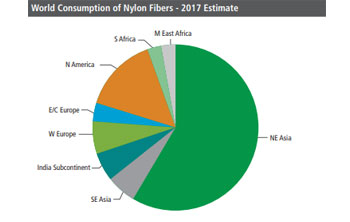

Northeast Asia consumes 78 percent of the world's nylon fiber for textile filaments and 48 percent of the world's nylon fiber for industrial filaments. In both cases, China is the largest consumer in the region. China's textile filament market is expected to be the fastest growing in the next five years, at about 3 percent per year.

Northeast Asia has also become the world center for manufacturing nylon fiber, account for nearly two-thirds of the world’s nylon fiber output. China accounts for the majority of that expansion. In the past five years, the production of nylon fiber in China has increased at about 6.7% per year, but is envisaged to slow to 2.8 percent per year in five years’ time. Most other Asian countries, such as Japan, South Korea, Taiwan, and India, experienced no growth or even declining production. North America and Western Europe are expected to remain, at best, stable as producers of nylon fiber. Both regions are important nylon fiber consumers, but both regions are growing at below-average rates.

Northeast Asia has also become the world center for manufacturing nylon fiber, account for nearly two-thirds of the world’s nylon fiber output. China accounts for the majority of that expansion. In the past five years, the production of nylon fiber in China has increased at about 6.7% per year, but is envisaged to slow to 2.8 percent per year in five years’ time. Most other Asian countries, such as Japan, South Korea, Taiwan, and India, experienced no growth or even declining production. North America and Western Europe are expected to remain, at best, stable as producers of nylon fiber. Both regions are important nylon fiber consumers, but both regions are growing at below-average rates.

Carpets and rugs account for the remaining 15 percent of global nylon fiber, with little or no growth envisioned. Once the premier fiber next to wool, nylon has seen demand soften. This market has continually been eroded by consumer preferences for hard surface flooring as well as polyester filament gaining acceptance in the residential market. North America and Western and Central Europe continue to be the major producers of carpets and rugs, accounting for about 78 percent of the nylon fiber consumed.

Nylon as an Engineered Plastic

Nylon became the first engineered plastic in the 1950s, when fiberglass reinforcement was first compounded into polymers to impart added performance. The properties of nylon, which include mechanical strength and toughness, heat endurance, resistance to oils and greases and good electrical insulation characteristics, make nylon an effective substitute for metal and other traditional materials in many durable, load-bearing engineering applications. Nylon engineering resins consume 33 percent of the nylon 6 and 60 percent of the nylon 6,6 produced globally. Nylon engineering resins and nylon fiber resins are produced by the same polymerization technologies, and while some tailoring occurs to optimize the product for engineering or fiber uses, the two resin products are similar and are often made in the same facilities.

Nylon 6 has somewhat lower heat resistance than nylon 6,6 but has advantages in terms of aesthetics (especially in reinforced compounds), easier colorability and a historically lower cost. In practice, there is significant overlap in the performance of these two major nylon types. While the preference for 6 versus 6,6 varies by region, nylon 6 continues to hold the largest volume share of engineering plastic nylon resin globally by virtue of its broad use in the production of film used in packaging.

Nylon 6 and nylon 6,6 in engineering applications are most often made from a blend of the polymer with reinforcements, fillers, and additives. The blend, or compound, is produced during the compounding process, typically using a twin-screw plastic compounding extruder, although other types of compounding equipment can also be used. The ratio of polymer, reinforcements, fillers, and additives are formulated to optimize the properties of the compound to end-use requirements, to improve the processing characteristics of the compound during end-use article manufacturing, and to minimize cost. Improvements in compounding technology and improvements in reinforcements and additives, along with improvements in nylon polymer technology, continue to advance the performance profile of both nylon 6 and nylon 6,6. As a result, nylon 6 and nylon 6,6 continue to capture applications with ever more demanding end-use performance requirements.

Automotive uses are the largest application for nylon resins, accounting for 36 percent of the nylon resin consumed in recent years, and are forecast to grow at about 2.7 percent per year for the next five years. The forecast for automobile production shows growth of about 3 percent per year, with 2020 global production surpassing 100 million units. Regions with above-average annual growth rates for vehicle production include the Indian Subcontinent, Southeast Asia, and Central Europe. Northeast Asia, the largest vehicle-producing region, is expected to grow at an average rate of 3 percent per year. Nylon 6 and 6,6 resins are now typically compounded with a variety of materials to improve their material properties.

Applications include a wide variety of interior and exterior hardware and under-the-hood parts that require heat resistance, strength, and good aesthetic appearance. Automotive applications generally require the properties of nylon compounds, which include fiberglass and/or mineral reinforcements, heat stabilizers, and impact modifiers. Further growth in automobile production is likely to support the continued geographical shift in OEM production, thermoplastic compounding, and molding operations, because the manufacture of bulky finished components tends to remain close to the assembly point.

Applications include a wide variety of interior and exterior hardware and under-the-hood parts that require heat resistance, strength, and good aesthetic appearance. Automotive applications generally require the properties of nylon compounds, which include fiberglass and/or mineral reinforcements, heat stabilizers, and impact modifiers. Further growth in automobile production is likely to support the continued geographical shift in OEM production, thermoplastic compounding, and molding operations, because the manufacture of bulky finished components tends to remain close to the assembly point.

Other rarer applications with above-average growth for nylon resins include electrical insulators, electronics, and appliances. The average annual growth rate for nylon resin consumption in electrical and electronic applications will be about 5 percent through 2020 and will account for about 20 percent of the nylon resin volume growth in the next five years.

Film and coating consumed about 13 percent of the global demand for nylon resins of late. The average annual growth rate for nylon resins in film and coating applications is forecast to be about 0.6 percent over the period 2015–20. Its primary applications are in flexible packaging for meat and cheese. The film products for these foods require high barrier properties.

Is Nylon 6,6 Higher in Value?

It all depends on the application. Although both nylon 6 and 6,6 are derivatives of oil, nylon 6,6 is generally more expensive to produce, given the complexity of the process, process yields, feedstock stream, and energy requirements. The value, however, is determined how well each performs in its intended end use, and whether the product properties such as melting point and durability differ because of the molecular bonding differences in the two.

In engineered plastics, the workhorse nylon 6,6 compound product is glass fiber reinforced, heat-stabilized, black nylon 6,6, which has a heat deflection temperature of around 250°C versus 220°C for a comparable nylon 6 compound. In some instances, engineers choose nylon 6,6 for the advantage obtained in heat resistance. Nylon 6,6 was the earliest engineering plastic and has been among the most successful. Today, engineering plastic applications account for 60 percent of the world's nylon 6,6 resin demand.

In engineered plastics, the workhorse nylon 6,6 compound product is glass fiber reinforced, heat-stabilized, black nylon 6,6, which has a heat deflection temperature of around 250°C versus 220°C for a comparable nylon 6 compound. In some instances, engineers choose nylon 6,6 for the advantage obtained in heat resistance. Nylon 6,6 was the earliest engineering plastic and has been among the most successful. Today, engineering plastic applications account for 60 percent of the world's nylon 6,6 resin demand.

In fibers, the preference is clearly for nylon 6,6 for industrial applications. Its higher heat resistance allows it to be used in tires where heat or heat generation is a factor, either in manufacturing or in the running of the tire itself under high load or speed. Its combined properties of higher strength, shock absorption, and elastic recovery also make it ideal for high performance and aircraft tires. Auto airbags benefit from the strength, elasticity and chemical and aging resistance. The demand and value for nylon 6,6 has been less noticeable in recent years in textile, carpet (BCF), and staple applications, which have changed with style trends, or moves to alternate fibers altogether, such as polyester.

What is the Future for Nylon?

Despite many new polymers invented and commercialized since 1939, the demand for nylon continues to grow. The nylon resin market is growing at about 3 percent per year and expected to continue at this rate to 2020. Most volume and volume growth will be in fiber applications; but at a slowing pace of just over 2 percent per year as trends in apparel move more to polyester. Nylon engineered resins will continue to prosper in the automotive industry, especially as manufacturers look to replace more heavyweight metal components. Product properties continue be enhanced, increasing the conditions under which nylon can be used, somewhat making up for the fact that there are very few new markets opening up.

Looking longer term, the world will continue to shift. More cars will be electrically powered, regional energy and feedstock sourcing and economics will change, competing materials will emerge, sustainable bio-based and eco-friendly routes will be developed, government policies on trade will shift, and consumer preferences will change. Likewise, the demand for all polymers will continue to shift, but there is no end in sight to the demand for nylon. Nylon has truly been revolutionary. IHS Markit is at the forefront of understanding these chemical markets, as well as many others; providing insight and analytics that help drive better decisions for the future of our clients and industry in general